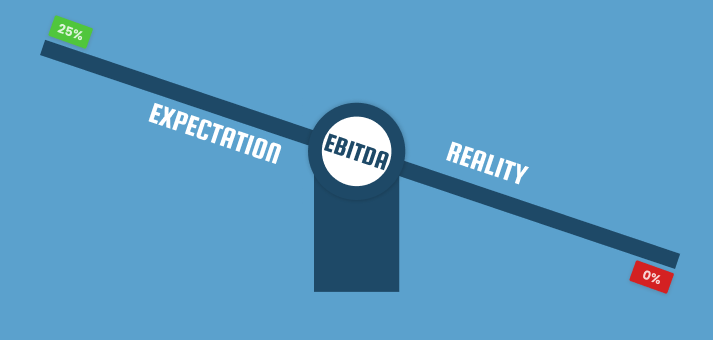

“From Expectations to Reality: Understanding EBITDA Variations”

Have you ever felt like you’re navigating a complex maze in the world of consumer brand management? You have set your sights on a healthy 25% margin, only to watch it vanish by year-end! Scary? It’s a nightmare scenario no business wants to face.

Consider this: A promising brand, full of hope and ambition, suddenly derailed by hidden operational traps. As the months roll by, the cracks start to show. Sales numbers don’t add up, costs skyrocket, and that 25% margin feels like a distant memory. By year’s end, you’re left bewildered, pondering where it all went astray!

"Decoding Profitability Challenges in the Marketplace"

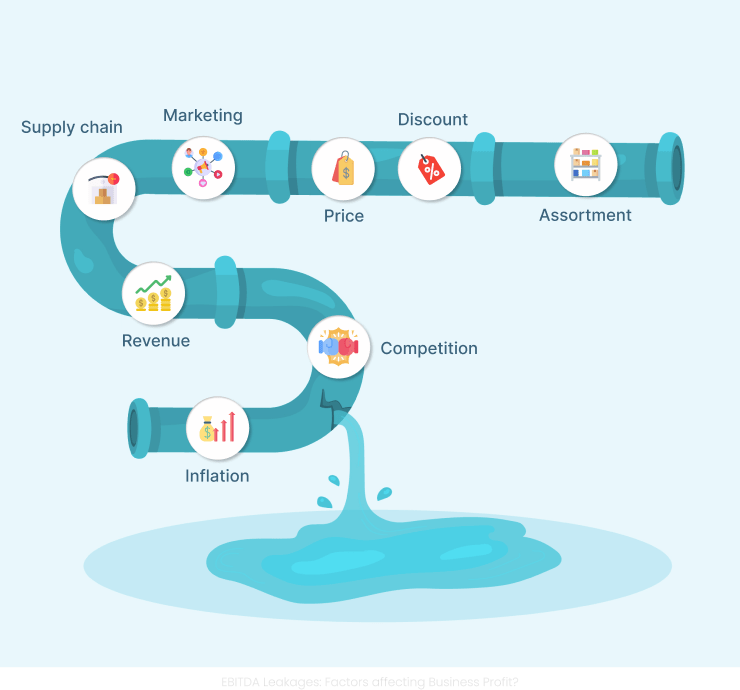

- Assortment:

- Discount:

Imagine the allure of discounts turning into a double-edged sword. While they attract customers, they also chip away at your margins, leaving you with dwindling profits.

- Pricing :

Your pricing strategy, once thought to be foolproof, now reveals its flaws. Inaccurate pricing not only confuses customers but also erodes your bottom line, leaving you scrambling to regain control.

- Marketing:

Your marketing efforts, meant to drive sales, seem to have a mind of their own. Despite hefty investments, they fail to deliver the expected returns, leaving you questioning their effectiveness and draining your resources.

- Supply Chain:

- Revenue:

- Competition:

The intense competition challenges you with pricing battles and innovation demands, impacting your margins and market share. Adapting strategies is crucial to sustaining profitability and addressing EBITDA gaps amidst aggressive market forces.

- Inflation:

As inflation rears its head, your costs spiral out of control. What once seemed like a reasonable expense now feels like a heavy burden, squeezing your margins and leaving little room for profit.

Beyond pricing and data breakdowns, other factors could contribute to EBITDA gaps. Market competition, shifts in consumer demand, regulatory changes, operational inefficiencies, macroeconomic shifts, quality control issues, strategic misalignment, and high debt levels can significantly impact profitability.

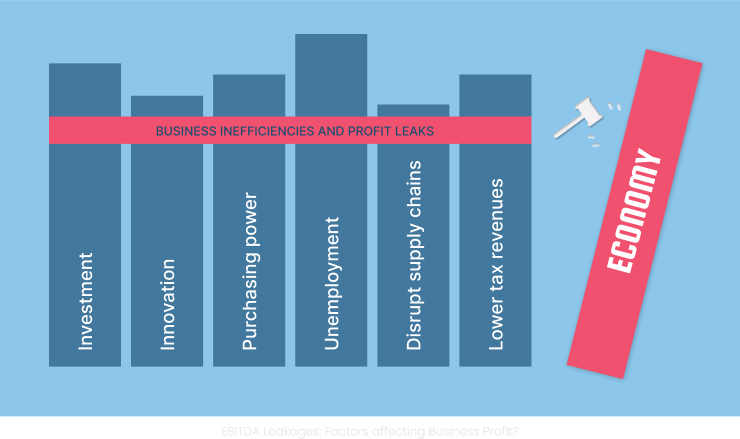

How Business Inefficiencies Impact the Economy?

If you think that business inefficiency and profit leaks affect a few companies, think otherwise!

Business inefficiencies and profit leaks don’t just affect individual companies; they have far-reaching implications for the overall economy. When businesses lose profits due to inefficiencies, it hampers investment and innovation, slowing down the macro economic growth. Job losses or reduced hiring can lead to unemployment, while lower tax revenues strain government budgets. Inefficiencies can even disrupt supply chains and ultimately lead to higher prices for consumers, reducing purchasing power.

Businesses facing profit leaks may struggle to compete effectively, leading to market instability and economic uncertainty. Addressing these inefficiencies is therefore the need of the hour not only for individual businesses but also for the health and stability of the broader economy.

"Transforming Challenges into Strategic Advantages"

While the journey from expectations to reality in managing EBITDA discrepancies is riddled with challenges, it’s also brimming with opportunities for growth and resilience. Revenue growth is good. Profitable growth is better, says McKinsey’s “The triple play: Growth, profit, and sustainability”.

Understanding the intricate interplay of factors like pricing, marketing, inventory management, and beyond, empowers businesses to transform what may seem like setbacks into strategic advantages.

As companies shore up their efficiencies and plug the leaks in their revenue streams, they not only safeguard their success but also contribute to the vibrancy and stability of the broader economy.

In the unwavering pursuit of profitability, every obstacle conquered is a resounding testament to the exceptional ingenuity and adaptability fueling our economy forward.

Summary

This post will equip you with the necessary knowledge to navigate the complexities surrounding EBITDA variances for consumer brands and empower you to take charge of your business’s profitability. In our next discussion, we will delve into practical strategies guaranteed to help you tackle these challenges head-on, achieve optimal business performance, and take your business to the next level!

References:

- How Inflation Affects Small Businesses

- Inflation Affects More Than Just Small Businesses’ Bottom Lines

- Amazon is making grocery brands pay for losses on Prime Day promotions, as focus on profit grows

- E-commerce firm Flipkart loss widens 45% to Rs 4,891 crore in FY23

Shravan Talupula

Founder, ProfitOps